I wrote about the TRAPP framework which helps us make sense of why and how the market differentiates between stocks or asset classes, even.

Today i want to talk about a technical aspect that leads to super-performance.

What do you think is the biggest contributor to a stock’s out-performance? Most would say earnings. Some sophisticated investors would say it’s the delta in the earnings. While both earnings power and the delta in earnings are very important, what really defines if you make a good investment or a superlative one?

The answer in my experience is, NEGLECT.

If a positive event in a stock meets with prior neglect - it automatically leads to super-performance.

Just look at the best performing stocks over any period and you will see the one thing common in most, if not all, is that the uptrend began from a period of neglect.

Those who follow price action often talk about breakouts. What is a breakout? It’s essentially a breakout from neglect. When a stock makes a large base it is essentially being neglected for that period i.e. neither bulls nor bears are interested. To be fair neglect often is not the catalyst itself its just the environment from the which a catalyst can give super normal returns.

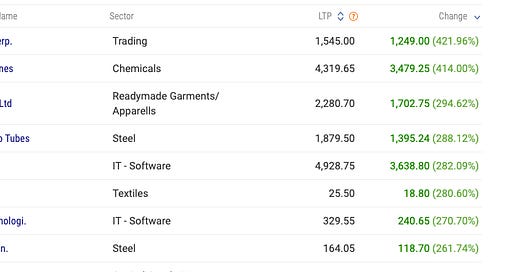

Let’s look at the top performing stocks in the last one year:

Now go their monthly charts are look at the period for which they were trading in a range - essentially neglected.

Typically what you see is an atleast 3-4 year - in some cases upto 7-8 years or more - neglect followed by a rerating phase.

If there was no neglect, then these stocks would not be able to make it to the top of the list like they did.

Neglect ensures that there is no froth and that the buyers and sellers have exhausted themselves. This sets the stage for the run-up as and when an earnings catalyst appears.

This is also why once the stocks become popular they are unlikely to be super-performers.

So next time you consider a stock for investment or trade look at where the stock is on the neglect scale. If its too popular i.e. it’s far away from its base then it means the probability of super-performance is low. If however the stock has gone no-where for several years and a new catalyst has emerged then the probability of this becoming a multibagger is that much higher.

Remember this equation:

New 52 week or New ATH in a stock + prior NEGLECT = SUPER-PERFORMANCE.

Don't you think that by following this strategy we need to keep hoping onto stocks which isn't a flavour of the town or lately market has started to like it. Whereas, if execution and earnings of the company is in place then they won't be able to hide it from market for too long.

So the dilemma is which is more preferable,

1. Compounding return on those stocks which are known to market.

2. ATH+ Neglect

Want to pick your brain on the above.

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e