Global Markets

Global markets remain a mess. However they all have recovered from the Russia Ukraine war lows seen in June. Now its a cat and mouse game going on between the Fed and the market.

Every bear market since the beginning of this century has ended only with a Fed pivot. This time should be no different.

US analysts are expecting a recession just so that Fed can pivot to a dovish policy. The surprisingly good GDP growth numbers coming out of the US economy disappointed the markets and they promptly fell post the release to go towards making new lows for the year.

Japan also surprised with tightening for the first time in several decades citing inflation.

Low interest rates are the drug and global markets are the junkies. They are now forced to go through a withdrawal - which no doubt has been painful and will continue to be so till Fed provides relief, driven by softening inflation.

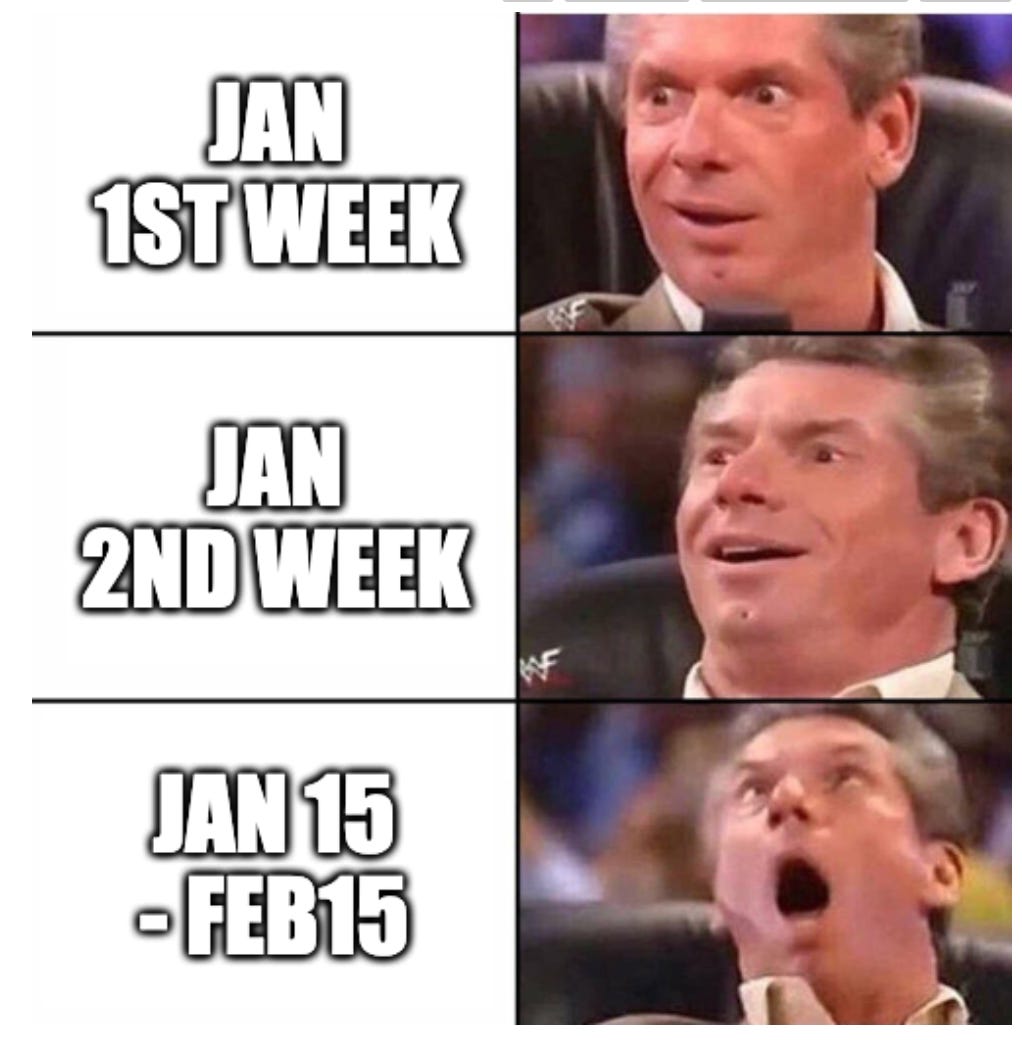

My own sense is that given the base effect kicking in April or July quarters is where the inflation may start receding and Fed may relax on the tightening. Expect markets to start rallying in the next 3-6 months unless there is any other new surprise event.

Two stocks belonging to two sides of the fundamental spectrum were holding on till last month but have given up now. Apple and Tesla. One of them is one the strongest businesses ever with boat-loads of cash on their book while the other one is more like a start up with a maverick CEO. Both of them were holding up while other names in the FAANG were taken to the cleaners. The market has now expectedly come knocking on their doors.

This is a good thing.

Like i mentioned in the previous posts, the bear market only ends once their leaders of the previous bull run get beaten down in multiple legs.

The leaders of the 2020-2021 bull market in the US were Tesla and crypto. We all know how bad crypto has had and now Tesla is doing what it should. Down 60%.

As these stocks get beaten down we will know that we are closer and closer to the end of the bear market.

A Big Mistake most will make.

This is a typical mistake people make after every bull market. Chase the leaders of the previous bull market as they keep correcting. They keep buying as the fall continues and provide exit to institutions.

I already keep hearing from so many people that facebook has gotten cheaper, amazon has gotten cheaper. Lot of retail money is likely to get stuck in the old names.

The big opportunities will be in the new names. New companies with an earnings tailwind, with no froth, lower market caps. That is where opportunities will be.

Especially with US, it’s an innovation machine. A lot of new companies are going to emerge and that is where institutions will focus. Retail also needs to keep an eye there.

If not, stick to the index. Index will do the job of pushing out the legacy names and bringing in the new names - although with a lag. But that will be still better than getting stuck in old leaders which will take years to take out their old highs.

Mind you, the businesses of these leaders will continue to thrive, we are only focussed here on the stock price which most likely will stagnate.

India.

What an amazing market we are having. As mentioned in the previous posts the out-performance to large global markets continues.

We did have a scare between 21-23 Dec and what a sharp fall it was. The Nifty investors won’t realize it but stocks, especially mid and small caps were beaten out of shape in a matter of three days. The severity of the fall was something that was not seen in the last few months at-least.

This type of a fall is called a “shake-out”. Its pushes out the leverage from the system and primes the market for making a new high. Whether it was a shakeout or a change of trend is known only in hindsight though.

Shake-outs are an edge for those who can sit through volatility, as the pull backs from a shakeout are very sharp - which has been the case this time. Most of the pain from the correction was in stocks which did well in the last few months but they bounced back equally ferociously.

This bodes very well for the stocks technically - especially those with tailwinds.

Overall, the relative strength of our markets has petered down relatively from last month but there is nothing in the behaviour to conclude that any sort of mean-reversion has started.

Sectors in Play.

I have been talking about a few sectors since the last few market notes and i am glad they have been doing very well.

The focus very clearly has been on one sector: tier 2 financials which includes banks and NBFCs. Like i explained last time, the Q2 results were blockbuster for many of these names and went to show that the old credit cycle is fully provisioned for. We are at the beginning of a new credit cycle which means the growth will be sustained and NPAs at least for the next several quarters won’t be a big issue. This is a goldilocks scenario for financials and the markets are reflecting that.

I expect many to rally back to their highs and beyond, in anticipation of their Q3 numbers. If the Q3 numbers continue to be robust, the re-rating will continue. If not, expect punishment.

Some stocks in this sector have gone up disproportionately given their low float. One needs to be careful if you own such names and keep booking profits and reducing exposure as the prices go up.

The other new sectors which seem to be primed to do well are:

Steel - Steel has been coming into the radar after a while led presumably by opening up of China and a general return of the demand as the war settles down. Select steel names have been showing strength, the numbers are yet to play out. Q3 results and commentary should be watched for this sector.

Fertilizers - probably driven by newsflow around subsidies as the budget is coming up. There has been a general shortage of fertilizers across Europe which should bode well should they be allowed to export or get better realizations than earlier.

Sugar - Another sector which shows signs of improvement led both by global sugar prices as well as the Ethanol blending opportunities. With sectors like steel, fertilizers and sugar one needs to be more careful as they are highly volatile both business wise as well as market wise. The allocations should take into account these factors.

Infrastructure - Some of the infra names are doing well in a bad market. Again watch the Q3. Generally they have robust Q3 and Q4, as Q3 is post monsoon and Q4 is year end which are both generally good quarters for business .

Railways - The wagon makers as well as the railway financiers seem to be in a sweet spot. Some of them have even reported very good earnings last quarter. Expect this tailwind to continue as the government continues to invest heavily in railways upgradation.

Defence - was one of the names we have been discussing in this segment. The leaders here have been the ship-builders. However with the govt’s recent allocation even others should start to fire. After the first leg and a few months of consolidation these names are ready for the next leg. Q3 results should be the trigger.

Q3 Results Season.

As you can see from above, Q3 results are very important for the stocks as well as the overall markets to make the next leap.

Analyzing results is one of the activities i enjoy the most.

Learning how to analyze results and its likely impact on the price is not only a life-long skill but one of the best shots at generating alpha. I hope to do a few zoom calls to teach you how you can begin to play the earnings explosion trades. It includes:

What’s the earnings trade all about?

What’s the edge in earnings announcement ?

How do you prepare for it?

How do you read the earnings?

How do you go about taking the trade?

When to enter

When to hold

When to take the gains?

When to take the loss?

How to think about allocation for this set up?

Although i am no expert and still learning everyday - this should give those of you who are interested a good and quick head-start.

Also like i mentioned last time i will try to publish an earnings digest this Q3 where we will talk about examples of earnings explosion from Q3 results.

Till then.

Happy Investing.

Excellent Insightful Article!

Good one